ORLANDO, Fla .(ANS) — Finances are undoubtedly at the top of most people’s minds these days with tax season upon us, and Christian nonprofits are no exception.

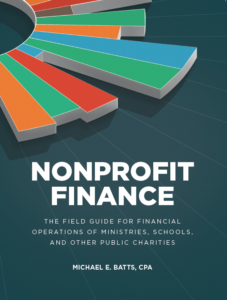

In the midst of a constantly changing financial landscape, it’s more important than ever for nonprofit organizations to build a solid foundation with integrity and purpose, says author and CPA Michael “Mike” Batts in his new book, Nonprofit Finance: The Field Guide for Financial Operations of Ministries, Schools, and Other Public Charities (Christianity Today International, March 2021).

The spring real estate market is booming and the nation is focused on economic recovery. Not only does the desire for financial stability and stewardship impact us personally, it also impacts many of the nonprofit organizations that we need and respect, including the private schools we attend and the ministries and public charities we support.

Michael E. Batts is the president and managing partner of Batts Morrison Wales and Lee, a national CPA firm dedicated exclusively to serving churches, ministries, and other nonprofit organizations across the United States.

“From tax compliance to best practices around stimulus money to understanding digital currency, the financial implications of the past year have been vast,” said Batts.

“Financial administration is a critical and foundational element of a sound and healthy nonprofit. With so many laws, rules, best practices and other considerations that can apply to the financial administration of a nonprofit, even the best financial and administrative leaders need help at times,” he said.

With nonprofits accounting for 10% of the jobs in the U.S. private sector workforce, Nonprofit Finance provides a timely and practical guide to help a multitude of schools, ministries and public charities successfully navigate financial administration with integrity while pursuing their nonprofits’ purpose. Batts, president of a CPA firm that works exclusively in the nonprofit sector, also delivers key principles that every nonprofit organization should know, including:

* Budgeting for your mission and purpose

* Properly establishing compensation for your leaders and staff

* Managing the liquidity and financial position of your ministry

* Enhancing accountability

* Understanding the fundamentals of federal tax law for ministries

* Employing ministry-wide risk management and more

While Nonprofit Finance can be applied to ministries, Batts has also written a guidebook specifically for churches called Church Finance, which provides additional details more unique to church needs.

Nonprofit Finance: The Field Guide for Financial Operations of Ministries, Schools, and Other Public Charities (Christianity Today International, ISBN: 978-1-61407-244-7). Softcover: $69.95; 279 pages.